Have you been laid off? Do you experience a money shortage at the moment? Thousands of people were fired last year due to the economic crisis and other reasons. Thousands of people are going to be fired this year. It’s unpredictable so you never know when it may happen.

If you are unemployed now you may urgently need money to support your daily needs. Is there a solution? You should take into account various aspects of boosting your personal finances during this challenging period.

In this article, we are going to talk about budgeting while you are unemployed, the best budgeting apps, and easy side gigs that might help you remain financially afloat.

Solutions for the Unemployed

When you lose your permanent position, many things may go wrong. Now you don’t have steady employment with a stable monthly income necessary to pay for rent, utilities, groceries, transportation, and other needs.

It may be frustrating but remember that everything is temporary in our life and so are your cash disruptions. Many people find themselves in the same situation at least once in their lives but there are many suitable ways out.

If you feel embarrassed or don’t have enough funds to turn to a financial advisor and face “I need a loan urgently” problem, you may benefit from the Fit My Money platform. This is a brilliant online tool for helping consumers become more financially literate with the help of free resources and relevant materials offered by the top experts in the financial sphere.

You may find everything you need about budgeting secrets, compare various lending options, and make smart financial moves. When you urgently need money it can be reasonable to take out a small loan to fund your immediate needs. It’s necessary to compare and review several options until you fully understand what decision will be the best fit for you.

Top Budgeting Apps to Help You

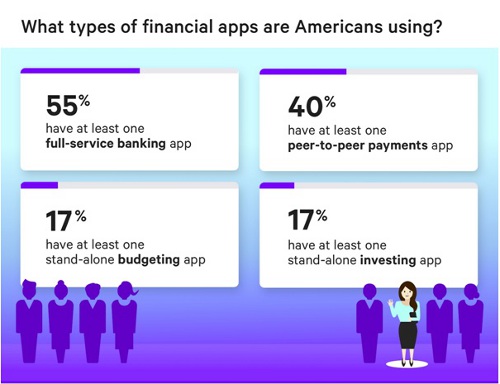

Financial uncertainties may easily unsettle you especially when you are temporarily unemployed. Luckily, there are many popular budgeting apps to help you keep track of your personal funds and boost your ability to cope with unforeseen costs.

All these apps have various useful features and options. Here are the top 5 budgeting apps to support your daily financial needs and help you stay afloat during tough times:

- Mint. It helps to synchronize all your bank accounts and manage them better. This way you will be notified about your investment or retirement accounts. Also, you may keep track of your personal finances and manage your credit cards and other types of loans you’ve taken. Monthly bills may be tracked through Mint so that you don’t miss any payments.

- Personal capital. This is another useful budgeting app that costs nothing. The Fee Analyzer feature allows consumers to find and track any hidden charges that might come with different lending services.

- YNAB (You Need a Budget). This is a useful app that has only 34 days of the free trial period. After that, consumers will have to pay $11.99 per month or $84 per year to utilize this service. This app allows you to give every dollar a job and assign your income to certain expenses and spending categories. You may create monetary targets and automated monthly payments if you need to repay a loan or make urgent repairs.

- PocketGuard. This app helps consumers know where their funds are going as well as manage their bills and costs. There are two memberships in it – core and plus. Core membership costs nothing while a plus membership costs $7.99 per month. The benefit of the plus version is the ability to export your transactions to Microsoft Excel which is helpful for those who like using spreadsheets for their budgeting.

Top 5 Side Gigs to Support Your Needs

When you have been fired and don’t have a steady source of monthly income anymore, you may want to look for alternative ways of finding a side hustle. Don’t just sit back and panic about your temporary financial disruptions.

You may solve everything and getting a side gig may be extremely helpful when it comes to necessary costs. Besides, such jobs are part-time and flexible. You can be your own boss with a chance of working as much as you want and when you want. Here is a list of the top 5 side jobs to make some extra cash:

- Delivery Driver/Ride Share. If ride-sharing is permitted in your city and you are familiar with your city, you may want to become a part-time rideshare or delivery driver. You can also deliver packages for various companies such as Amazon. There are many websites and platforms to help you find such side gigs which are rather flexible. You can choose your working hours. The only demand here is to have your own vehicle.

- Personal Assistant. It doesn’t only mean the assistant that works in the office. You may become a helping hand for somebody or even for a whole family if you can fix or build things and are handy about the house. Maybe you have great cleaning skills or can organize a daily routine for other people. This job is also flexible and allows you to earn some additional funds.

- Care Giver. Do you enjoy taking care of kids? Being a babysitter can help you fund your daily needs and obtain money while working part-time or only over the weekends. Websites and platforms like Care.com may assist you in landing such a position in your area.

- Dog Walker. This is a rather popular position and side gig. Many people who own pets may also become dog walkers or pet sitters as they already have experience. You can earn some money while walking the dogs or taking care of them in the daytime. Ask your friends or relatives if they need such assistance.

- Freelancer. Becoming a freelancer is a great opportunity to obtain extra funds for many people who also want to work from home. This side gig can even turn into a full-time position if you want.

Think about the relevant skills and abilities you can turn into a job. Such websites as Upwork, Editorr, FlexJobs, Fiverr or Freelancer.com might help you out.

All in all, there are many ways to boost your income even when you are unemployed at the moment. You can easily take out a small personal loan if you urgently need some funds. Finding a side gig and managing your current finances using the mentioned budgeting apps will also help you cut spending and get additional cash until your financial stability returns.